The tax cuts and jobs act passed in december 2017 made tax law changes that will affect virtually every business and individual in 2018 and the years ahead.

Irs section 1031 tax free exchanges.

Section 1031 is also.

Form 8824 department of the treasury internal revenue service like kind exchanges and section 1043 conflict of interest sales attach to your tax return.

The term which gets its name from irs code section 1031 is.

The term 1031 exchange is defined under section 1031 of the irs code.

Section 1031 is a provision of the internal revenue code irc that allows business or investment property owners to defer federal taxes on some exchanges of real estate.

1031 a taxpayer may defer recognition of capital gains and related federal income tax liability on the exchange of certain types of property a process known as a 1031 exchange in 1979 this treatment was expanded by the courts to include non simultaneous sale and purchase of real estate a process sometimes called a.

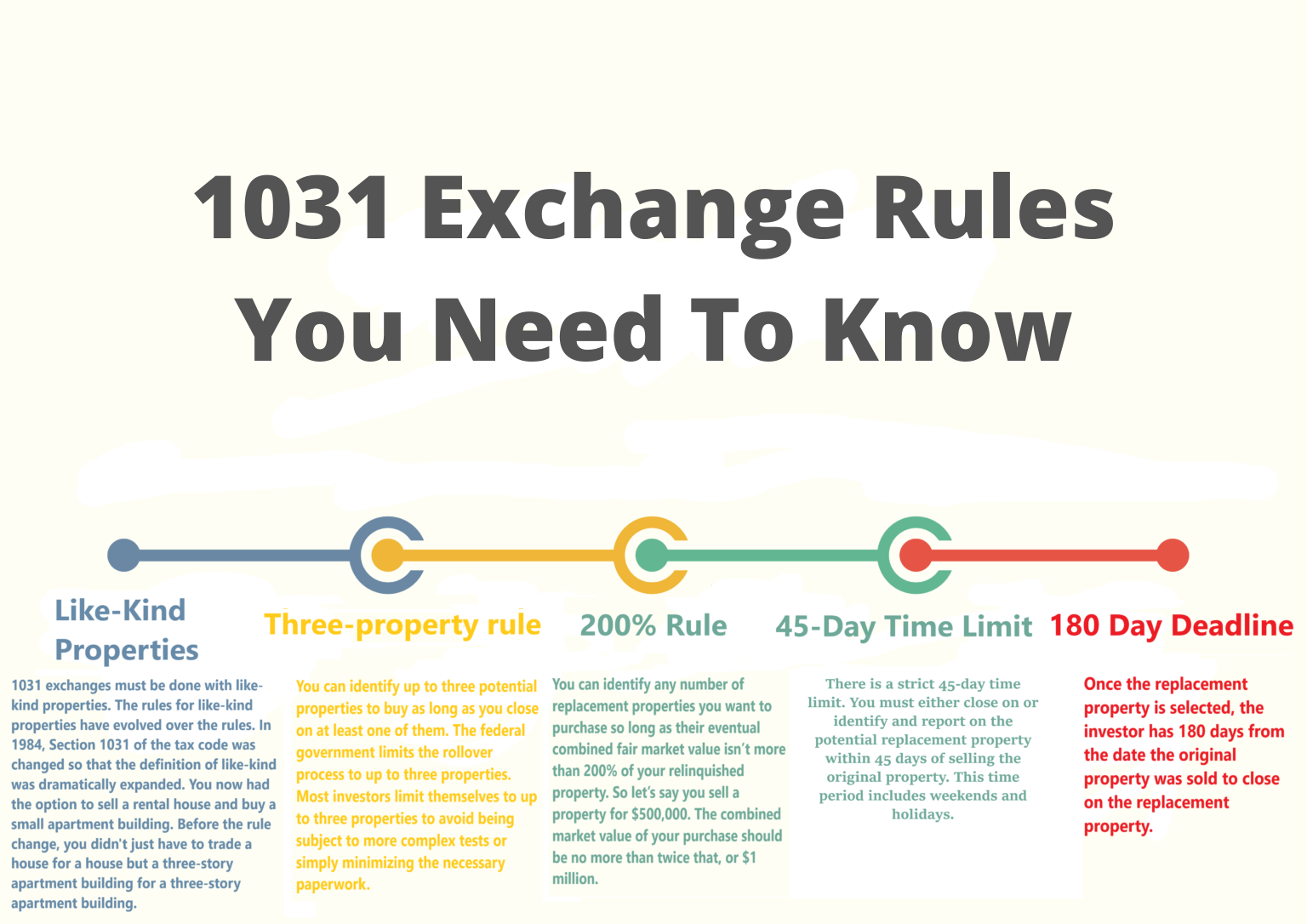

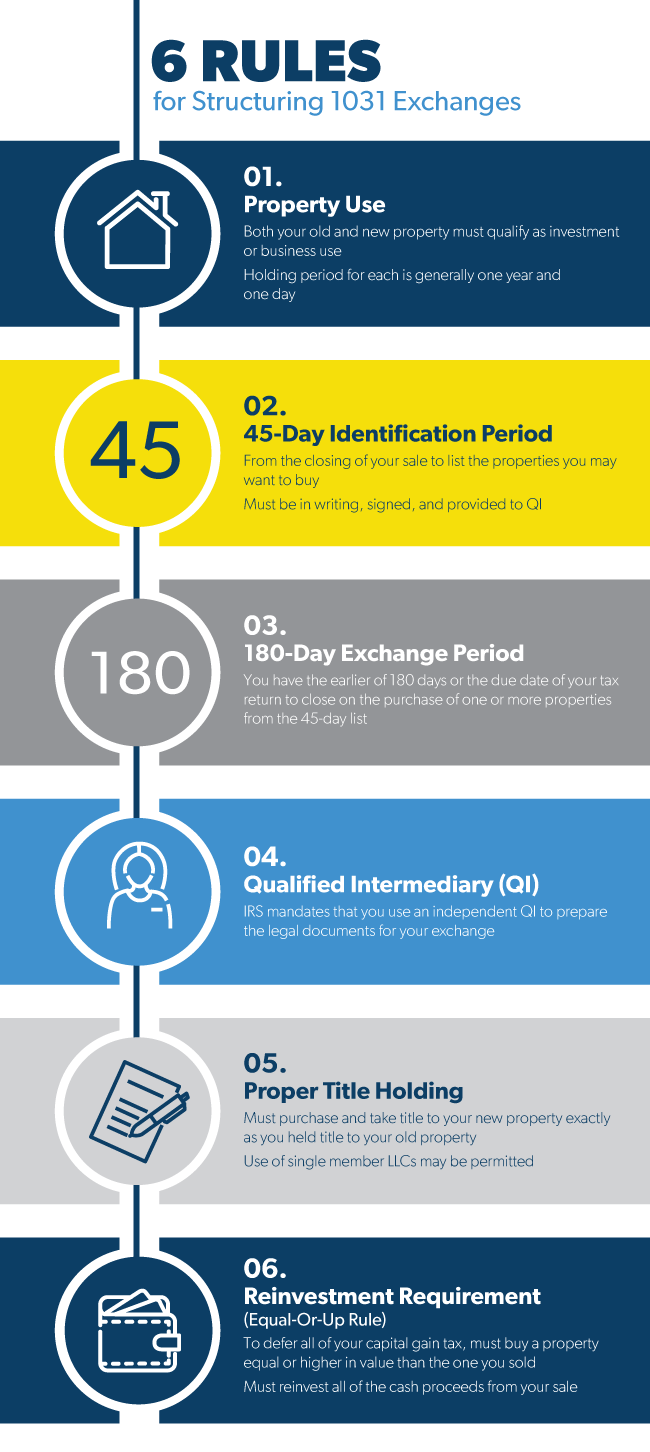

A 1031 exchange means that if you exchange your property with a like kind property any gain on the value difference will not be charged to tax under capital gains.

If you receive cash relief from debt or.

Ir 2018 227 november 19 2018 washington the internal revenue service today reminded taxpayers that like kind exchange tax treatment is now generally limited to exchanges of real property.

Gain deferred in a like kind exchange under irc section 1031 is tax deferred but it is not tax free.

We ll discuss like kind property in more detail in section four.

1 to put it simply this strategy allows an investor to defer paying capital gains taxes on an investment property when it is sold as long another like kind property is purchased with the profit gained by the sale of the first property.

Under section 1031 of the united states internal revenue code 26 u s c.

A 1031 exchange is a way to defer paying capital gains tax on the sale of property under section 1031 of the internal revenue service code.

As part of a qualifying like kind exchange.

Like kind exchanges when you exchange real property used for business or held as an investment solely for other business or investment property that is the same type or like kind have long been permitted under the internal revenue code.

Generally if you make a like kind exchange you are not required to recognize a gain or loss under internal revenue code section 1031.